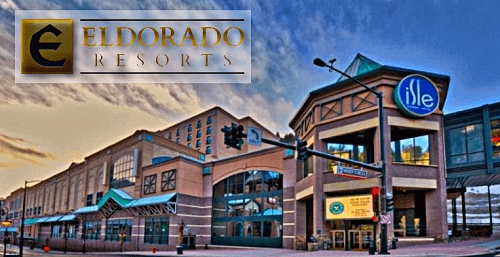

Eldorado Resorts will purchase Caesars in cash and stock deal that is set to be valued at $17.3 billion. The purchase will place about 60 casino resorts placed around the US under one company. The company will retain the name ‘Caesers’ and it will be based in the state of Nevada and its ‘presence’ will be felt in both Reno and Las Vegas. This deal comes three months after investor, Carl Icahn, was given three seats in the board by Caesers.

Eldorado Resorts will purchase Caesars in cash and stock deal that is set to be valued at $17.3 billion. The purchase will place about 60 casino resorts placed around the US under one company. The company will retain the name ‘Caesers’ and it will be based in the state of Nevada and its ‘presence’ will be felt in both Reno and Las Vegas. This deal comes three months after investor, Carl Icahn, was given three seats in the board by Caesers.

Caesars Entertainment and Eldorado Resorts have been locked in discussions over the purchase deal for several months. Brands such as Harrah’s and Horseshoe casinos are operated by Caesars Entertainment. Factors such as this will make this merger a huge success because it will create a gambling empire of note. This merger is a good thing for Caesars. The gambling and entertainment hub recently emerged from bankruptcy protection. Although they managed to bounce back from possible bankruptcy the company continued to struggle.

The Man in Charge at Eldorado Resorts

Current Eldorado Resorts CEO, Tom Reeg, is expected to be the man in charge of the combined companies. It’s been said that both companies believe that Reeg has exceptional leadership skills which are valued greatly by billionaire investor, Carl Icahn.

Reeg has been at the helm of Eldorado Resorts since January 1, 2019. He also served as the Director of Tropicana Entertainment prior to its acquisition by Eldorado Resorts. Reeg was quoted in a statement stating that this merger will create a powerful and iconic gaming and entertainment brand.

Details of the Deal

Eldorado Resorts is expected to pay $8.40 in cash per share. The company is also expected to assume Caesars debt as part of the deal. Eldorado Resorts shareholders will hold about 51% of the company’s stock and the remaining 49% will be in the hands of Caesars Entertainment. The deal is expected to be finalized in the first of 2020 should it gain approval from shareholders and gaming regulators.