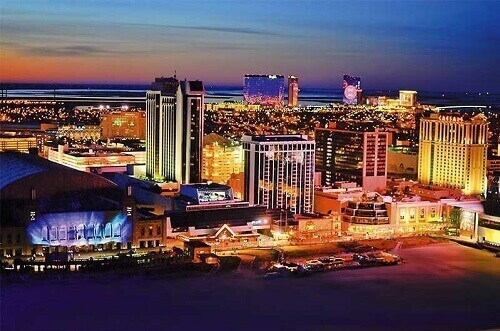

During the course of 2015, the gambling industry in Atlantic City, New Jersey, contributed $237 million in gambling tax to the state. This seems like quite a substantial figure; however, it pales in comparison to the revenue generated by other state’s gambling industries. Now, there are many in people out there who think this tax figure should have been higher.

Atlantic City has Second Lowest Tax Rate

Casinos in Atlantic City benefit from the second lowest gambling tax rate in the United States of America. Casinos pay an 8% tax on their gross revenues to the state of New Jersey, as well as an additional 1.25%, which is the community investment obligation tax. Out of all the other states in the USA, only Nevada has a lower gambling tax which sits at 6.75%.

Despite this, casinos have still been struggling in Atlantic City. In Nevada, the industry has bounced back from the 2008 and 2009 recession. In Atlantic City, though, five casinos have had to close their doors since 2008.

While many agree that perhaps the tax rate should go up, others are arguing that this is not the time. As the remaining seven casinos in Atlantic City continue to struggle to find stability, some say that this would be the worst possible time to suddenly add additional financial pressure.

Atlantic City Tax Revenue Pitiful

When we look at the top ten tax revenue generators in the United States, New Jersey doesn’t even crack the list. Interestingly enough, Pennsylvania is the highest earner, generating $1.37 billion in tax Casinos in Pennsylvania are hit with a 55% tax on slot machine revenue and an 18% tax on table games. Despite these high numbers, it doesn’t seem to have hurt the local gambling establishments.

Nevada was placed in second, with $882 million, while Rhode Island was in tenth place, with $335.5 million, significantly ahead of New Jersey. Land-based casinos have always been popular in Atlantic City, so we hope they’ll make a comeback.